Almost four months after the initial shockwaves of COVID-19, we have seen the world go from a near economic standstill to a slow restart. With this revival, M&A activity has picked-up especially this last week. The headlines have been exciting with Lululemon announcing the acquisition of the workout-from-home company Mirror ($500M), MasterCard acquiring fintech Finicity ($825M), Amazon acquiring the autonomous car start-up Zoox (~$1.2B), and rumors swirling of an Uber and Postmates merger.

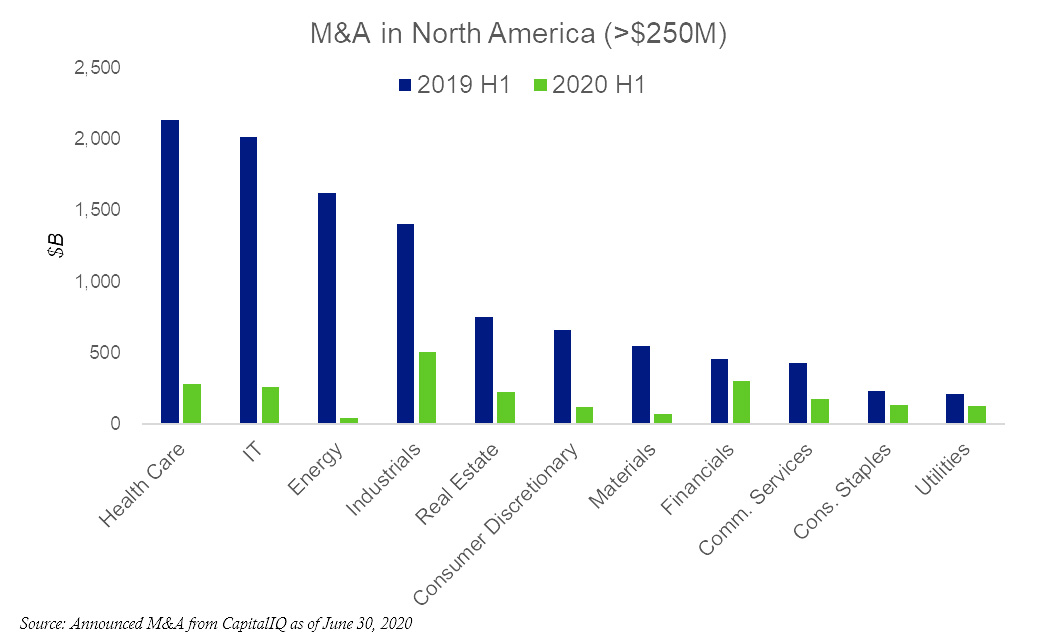

In the first half of 2020, all North American M&A activity with transaction values greater than $250M totaled $226B down dramatically from the first half of 2019 where we saw $1T in M&A. Most notably, health care, information technology (IT), and energy have been the industries with the most significant slowdowns. It is understandable amid COVID-19 and a global oil shock that M&A in health care and energy markets would slow down significantly. Surprisingly, we have not seen more M&A in IT as the world scrambles to accelerate digital transformation initiatives in the new COVID economy. We have seen some action when Cisco announced the acquisition of ThousandEyes, a network monitoring company.

Perhaps we will see non-tech companies emerge as aggressive buyers of technology companies as they try to retool for the COVID economy? Or maybe we will see forced consolidation in the gig economy as COVID pushes these business models to the brink? As we ask ourselves the question, why hasn’t there been more IT-related acquisitions; we realize this is likely a result of near record-high multiples in the face of an uncertain economy. While we cannot predict the future, many public companies and private equity funds seemingly have sizable cash war chests and appear to be thinking outside the box with M&A targets.

Perhaps we will see non-tech companies emerge as aggressive buyers of technology companies as they try to retool for the COVID economy? Or maybe we will see forced consolidation in the gig economy as COVID pushes these business models to the brink? As we ask ourselves the question, why hasn’t there been more IT-related acquisitions; we realize this is likely a result of near record-high multiples in the face of an uncertain economy. While we cannot predict the future, many public companies and private equity funds seemingly have sizable cash war chests and appear to be thinking outside the box with M&A targets.

This material does not constitute an offer to sell or the solicitation of an offer to buy any securities. Securities of any fund are offered to selected investors only by means of a complete offering memorandum and related subscription materials which contain significant additional information about the terms of such an investment. The foregoing consists solely of recent news relating to certain Portfolio Companies. These Portfolio Companies do not represent all of the investments made or recommended by Cross Creek. The reader should not assume that an investment in any Portfolio Company identified was or will be profitable. Past performance is not indicative of future results. Investors should be aware that a loss of investment is possible. The research for this material is based on current public information that we consider reliable, but we do not represent that the information herein is accurate or complete, and it should not be relied on as such. Our views and opinions expressed herein are current as of the date this material is sent and are subject to change without notice. Not all acquisitions or IPOs are profitable; the positions can be acquired at a price that is greater or less than the price at which Cross Creek purchases its interests for client accounts. A link to Cross Creek's direct company holdings is available on our website.