A little over two weeks ago, Toast made its debut in the public markets, and last week, AvidXchange filed their S-1 to go public. Toast provides restaurants with a cloud-based point-of-sale solution and a suite of other products, including payroll, benefits, reporting, analytics, and kiosks. AvidXchange is a platform that automates accounts payable and payments for mid-market businesses. On Toast’s first day of trading, the stock closed up 50%+ from the IPO price with a market capitalization of ~$30B versus its last private valuation in 2020 of $4.9B. We believe this highlights the investor appetite for what we are calling embedded fintech business models. Toast and AvidXchange are companies that have mixed business models. In our opinion, an embedded fintech business is any software company embedding financial products into their workflows such as payments, payroll, loans, insurance, bank accounts, or cards.

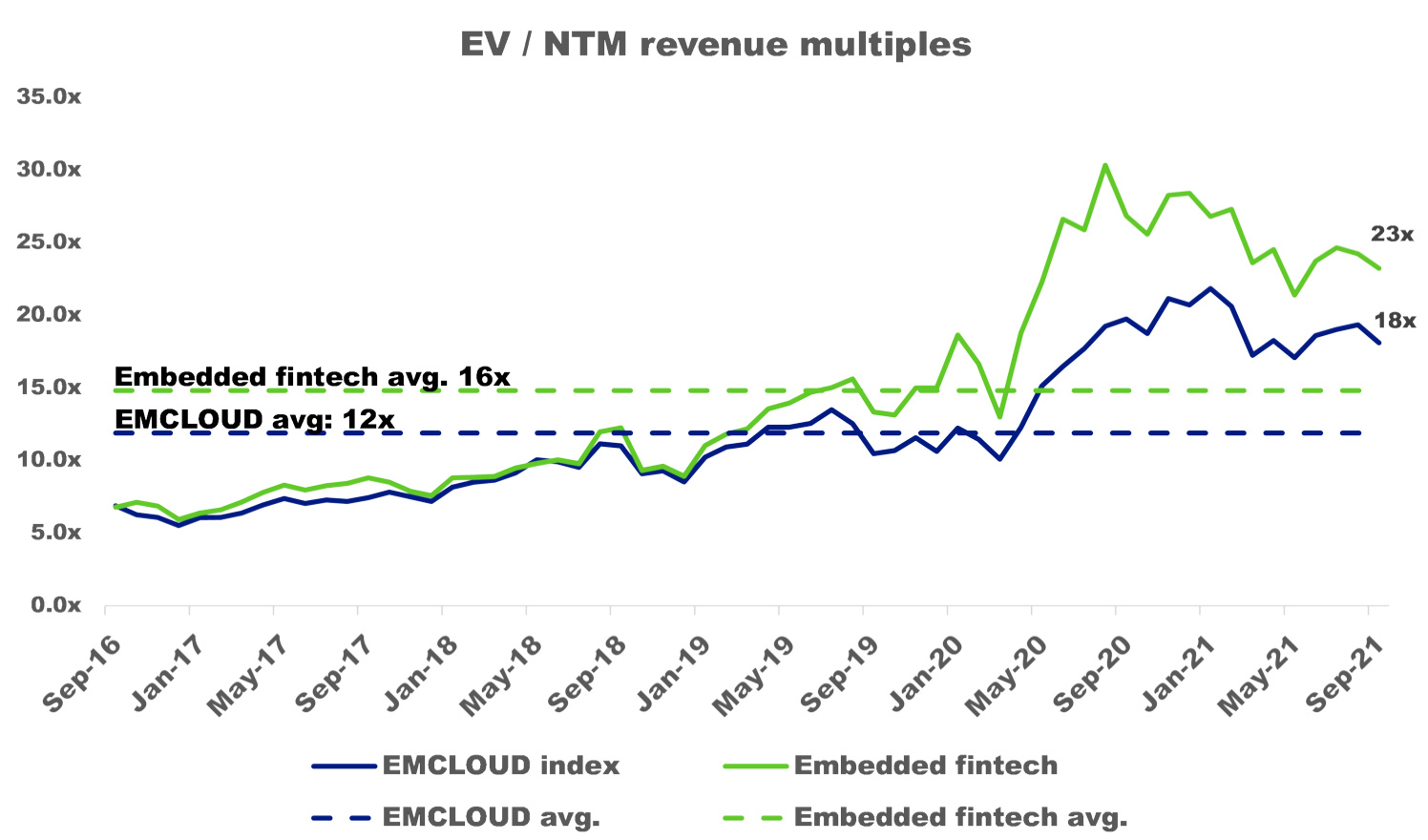

With the investor appetite we see in the markets for the embedded fintech businesses, we’ve studied the Bessemer Cloud Index (EMCLOUD), looking for companies that meet these criteria. Of the 58 companies in EMCLOUD, we’ve identified eight software companies that have a clear fintech component in their business model(APPF), BigCommerce (BIGC), Bill.com (BILL), Coupa (COUP), Paylocity (PCTY), Paychex (PAYC), Shopify (SHOP), and Wix (WIX). To better understand how public markets value SaaS companies vs. embedded fintech businesses, we’ve plotted the historical EMCLOUD forward revenue multiples versus our embedded fintech group.

At first blush, it appears that embedded fintech companies are getting a meaningful premium from investors; however, we believe there are limitations to this analysis. First, the embedded fintech company set is a small sample size. Second, we think some qualitative considerations don’t neatly fit into a ratio, such as the quality of a management team, market size, or long-term business prospects of an industry. We’ve also considered that the embedded fintech companies might be growing faster than their EMCLOUD peers and subsequently valued higher, which they are. Interestingly, the median growth rates for both groups are within two percentage points of each other. There is nuance here as some companies across both groups have benefited differently from factors such as COVID and M&A.

At first blush, it appears that embedded fintech companies are getting a meaningful premium from investors; however, we believe there are limitations to this analysis. First, the embedded fintech company set is a small sample size. Second, we think some qualitative considerations don’t neatly fit into a ratio, such as the quality of a management team, market size, or long-term business prospects of an industry. We’ve also considered that the embedded fintech companies might be growing faster than their EMCLOUD peers and subsequently valued higher, which they are. Interestingly, the median growth rates for both groups are within two percentage points of each other. There is nuance here as some companies across both groups have benefited differently from factors such as COVID and M&A.

While we can’t say for sure why embedded fintech companies are receiving premium multiples, we are bullish on these business models for a few reasons:

Companies embedding a fintech component into their business models are increasing the overall addressable markets for these businesses.

As software companies morph their business models to include financial services, they become stickier and extend the lifetime value of their customers.

Financial products diversify software revenue streams and align better with customer business needs.

We know that many other private companies have embedded fintech into their business models and suspect there will be more IPOs on the horizon. Some of these private companies include Weave, ServiceTitan, Podium, Gusto, Slice, Shopmonkey, Entrata, etc.

As the SaaS business model evolved more than a decade ago, investors first approached it with trepidation, then enthusiasm, and now it is the norm for software companies. As the impact of fintech embedded into the SaaS model becomes more widely recognized, we find ourselves asking, “will this premium persist or will the multiples adjust downwards as the novelty wears off as this business model becomes more commonplace?”

[1] Paypal (PYPL) and Square (SQ), were not included as we do not view them as embedded fintech companies.

Sources: CapitalIQ, Sec.gov.

This material does not constitute an offer to sell or the solicitation of an offer to buy any securities. Securities of any fund are offered to selected investors only by means of a complete offering memorandum and related subscription materials which contain significant additional information about the terms of such an investment. The foregoing consists solely of recent news relating to certain Portfolio Companies. These Portfolio Companies do not represent all of the investments made or recommended by Cross Creek. The reader should not assume that an investment in any Portfolio Company identified was or will be profitable. Past performance is not indicative of future results. Investors should be aware that a loss of investment is possible. The research for this material is based on current public information that we consider reliable, but we do not represent that the information herein is accurate or complete, and it should not be relied on as such. Our views and opinions expressed herein are current as of the date this material is sent and are subject to change without notice. Not all acquisitions or IPOs are profitable; the positions can be acquired at a price that is greater or less than the price at which Cross Creek purchases its interests for client accounts. A link to Cross Creek's direct company holdings is available on our website.