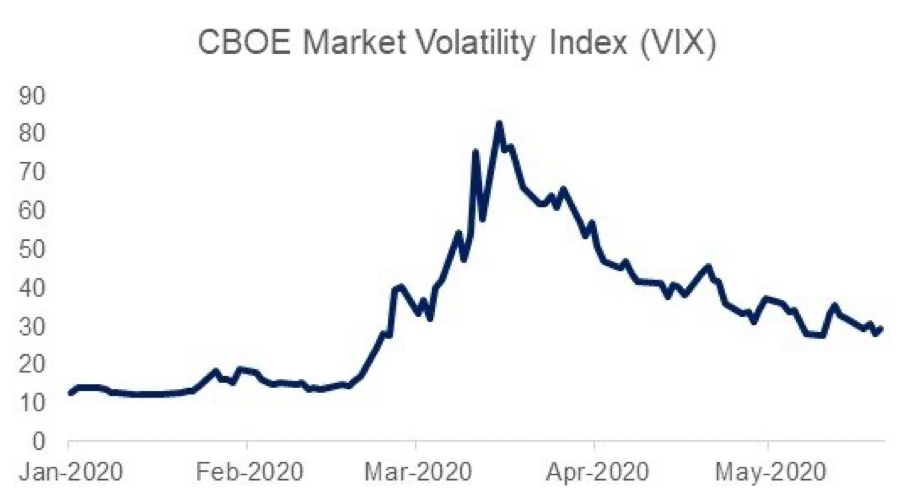

For the last two months, the coronavirus has all but shut the doors on equity capital markets outside of niche opportunities and biotech offerings. However, since the mid-March peaks in volatility, as measured by the CBOE Market Volatility Index (VIX), markets have rallied, and volatility has continued to decline, leaving many to wonder when and if we will see companies test the waters of raising capital through an Initial Public Offering (IPO).

Source: CapitalIQ as of 5/21/2020

Source: CapitalIQ as of 5/21/2020

Kingsoft Cloud’s May 8th IPO (Nasdaq: KC) represented that test as the first major listing in the U.S. in two months. The stock priced at $17 per share, raised $510 million and closed on the first day up 40%. While the deal was heralded as a success, it was not a perfect mark for many U.S. venture backed companies waiting in the wings to make their debut. The company was domiciled in China, spun out of Kingsoft Corporation (3888.HK), and backed by one of China’s most prominent billionaires in Xiaomi co-founder and CEO of Kingsoft, Lei Jun. Today marks a new milestone in equity capital markets with SelectQuote (NYSE: SLQT) pricing its upsized IPO above the initial range yesterday to raise $360 million. Based on our conversations, the offering was well-received by institutional investors with the deal nicely oversubscribed even after the 3.5 million share upsize. The stock closed the day at $27.00 (up 35%) despite the weak tape and it now seems the IPO window has officially opened for more activity.

Who is next to test the waters of coming public with a virtual roadshow and a host of global economic unknowns? Some of the most talked-about names have been Vroom, with their $100 million S1 filing last week and private equity backed ZoomInfo with a widely anticipated $500 million offering. While investor risk appetite has seemingly bounced back from March's doldrums, we will be interested to see how much the focus returns to profitability and measured growth as opposed to the growth at all costs mentality that marred many of the headline IPOs of 2019. We believe that companies with the right scale, revenue visibility, and profitability prospects may consider raising capital via an IPO. With potential headwinds from an upcoming election and perhaps data indicating a prolonged economic downturn in the months ahead, it seems companies may have a narrow window for accessing the public markets.

This material does not constitute an offer to sell or the solicitation of an offer to buy any securities. Securities of any fund are offered to selected investors only by means of a complete offering memorandum and related subscription materials which contain significant additional information about the terms of such an investment. The foregoing consists solely of recent news relating to certain Portfolio Companies. These Portfolio Companies do not represent all of the investments made or recommended by Cross Creek. The reader should not assume that an investment in any Portfolio Company identified was or will be profitable. Past performance is not indicative of future results. Investors should be aware that a loss of investment is possible. The research for this material is based on current public information that we consider reliable, but we do not represent that the information herein is accurate or complete, and it should not be relied on as such. Our views and opinions expressed herein are current as of the date this material is sent and are subject to change without notice. Not all acquisitions or IPOs are profitable; the positions can be acquired at a price that is greater or less than the price at which Cross Creek purchases its interests for client accounts. A link to Cross Creek's direct company holdings is available on our website.