Spotlight on Manufacturing and Supply Chain

By Crystal Valentine, PhD

In a world where venture capital firms are raising multibillion dollar funds to invest in cryptocurrencies and blockchain-based web3 technologies, it can seem a little contrarian to talk about the virtues of the manufacturing and supply-chain sectors. However, we think it’s hard to argue that the global manufacturing and supply-chain sectors are not fertile ground for innovative businesses and technologies. After all, a common mantra among venture capitalists is that we look to invest in disruption. Between COVID-19 lockdowns, geopolitical uncertainty, and escalating international conflict, one would be hard pressed to find more disruption than what has happened to the global supply chain over the past couple of years. While consumers have become aware of some unusual consumer-product shortages (such as toilet paper, bicycles, garage doors, baby formula, and beer), manufacturers have felt the effects of supply-chain disruption much more acutely. For manufacturers, disruption can mean longer production times, higher costs, and lower customer satisfaction.

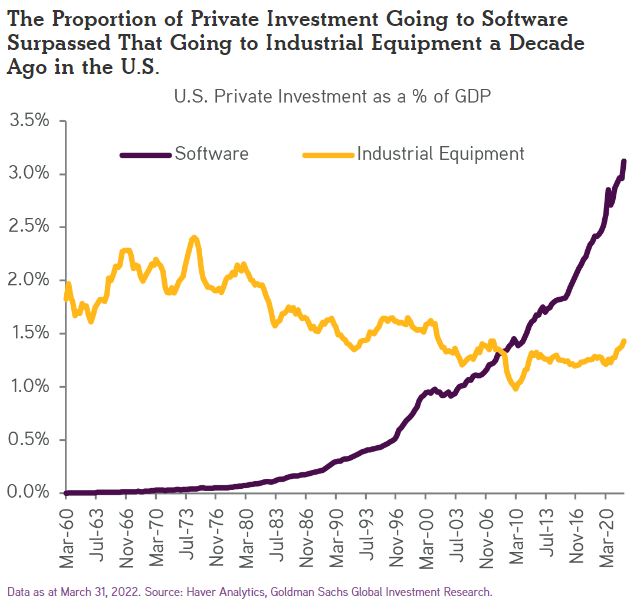

Venture investors have largely ignored industrial manufacturing for more than a decade, preferring to focus on the higher-margin, predictable revenues of subscription software companies. However, investment in digital transformation, a major secular tailwind supporting the growth of countless software companies, is also a major trend within the much larger manufacturing industry. According to Statista, the industrial manufacturing market is nearly $8 trillion in the United States alone. While this number admittedly includes a broad swath of enterprises engaged in everything from chemicals to automotive, manufacturing is an undeniably large proportion of the U.S. economy. By comparison, the global SaaS market, an area very well-trodden by venture investors, is less than $250 billion. Despite the relative size and importance of the manufacturing sector and the striking need for modernization and innovation, private investment in companies related to industrial manufacturing has stagnated while investment into software companies has grown exponentially over the past decade.

As investors, we believe that disruption creates new opportunities. Entrepreneurs who identify real problems, or changing needs, create the innovation that fuels economic growth. The challenges felt by manufacturers over the past two years represent a massive need for businesses to rethink how they source parts and how they react to—or even anticipate—disruptions in their supply network. At the end of 2021, The Economist described the new normal as “the era of predictable unpredictability.” Manufacturers have responded strongly to these sea changes. According to the National Association of Manufacturers, over half of U.S. manufacturers are reevaluating their entire supply chains. We believe there is a paradigm shift afoot wherein manufacturers are focusing on the adaptability of their supply chains in order to support a more agile procurement process.

In early 2021, we began a process of evaluating companies working to solve the hard problems faced by manufacturing companies related to decreasing production time, reducing waste, improving plant efficiency, and building adaptive supply chains. While we met with several innovative companies tackling these challenges, one name stood out. In February 2022, we participated in the Series E financing round for Fictiv, led by Activate Capital. Fictiv makes a cloud-based software platform that supports rapid prototyping and agile procurement for mechanical engineers within manufacturing companies. Fictiv is a great example of a company that is supporting digital transformation within the manufacturing sector by enabling companies to simplify sourcing.

Behind Fictiv’s platform is a highly curated network of geographically diverse manufacturing partners. When sourcing a part with Fictiv, engineers benefit from Fictiv’s ability to reroute any order dynamically in the event of a disruption to any manufacturing partner, yielding a transparently agile procurement process. Customers benefit from the wide range of manufacturing capabilities offered by the Fictiv network of manufacturers. Manufacturing partners and can utilize excess capacity in their shops without the need for additional sales and marketing overhead. Moreover, the Fictiv platform incorporates a set of complex analytical and matching algorithms. Using automation, Fictiv lowers the friction for engineers to iterate on their designs with an automated design for manufacturability engine that allows an efficient click-to-purchase experience for highly engineered parts. In today’s world, where time to market is everything, the benefits of reducing production time from weeks or months to days are enormous.

Perhaps most interesting in our learning process has been the observation that several principles developed by software engineering teams, such as “agile development” practices, can be applied to problems in other sectors to interesting ends. Companies using Fictiv lower the barriers between mechanical engineering and supply-chain teams, just as software companies employing DevOps practices lower the barriers between software engineering and operations teams. While many manufacturing companies remain mired in delays due to supply-chain disruptions, with no end in sight, Fictiv allows mechanical engineers to work at the speed of software—a pretty refreshing idea for the real economy.

While we remain interested in finding investments across sectors, we are excited to see the impact that Fictiv is having on the real economy, and we are happy to shine a spotlight on the need for more innovation to benefit manufacturing companies.

This material does not constitute an offer to sell or the solicitation of an offer to buy any securities. Securities of any fund are offered to selected investors only by means of a complete offering memorandum and related subscription materials which contain significant additional information about the terms of such an investment. The foregoing consists solely of recent news relating to certain Portfolio Companies. These Portfolio Companies do not represent all of the investments made or recommended by Cross Creek. The reader should not assume that an investment in any Portfolio Company identified was or will be profitable. Past performance is not indicative of future results. Investors should be aware that a loss of investment is possible. The research for this material is based on current public information that we consider reliable, but we do not represent that the information herein is accurate or complete, and it should not be relied on as such. Our views and opinions expressed herein are current as of the date this material is sent and are subject to change without notice. Not all acquisitions or IPOs are profitable; the positions can be acquired at a price that is greater or less than the price at which Cross Creek purchases its interests for client accounts. A link to Cross Creek's direct company holdings is available on our website.